Recently Sono Motors, a German car startup, announced that they reached their €1 million crowdfunding goal only a few days after the start of the campaigns (on Seedrs and WiWin). The goal of these campaigns, which are still running, is to collect money to start the mass production of their first vehicle, the Sion, in 2019. Before that, Sono Monotors also crowdfunded money for the first prototype of the Sion and reached €549,895 on Indiegogo.

That is interesting because it is the first time a car is financed by the crowd and despite it being a car it has raised less money than other less sophisticated projects. The Pebble Smartwatch, for instance, has raised over $20 million.

However, once you realize that they are a car coordinator instead of a manufacturer these comparisons make more sense. Sono Motors is neither manufacturing the components nor building the car itself. Nevertheless, the Sion is an interesting concept with some flaws, however.

The Sion

The Sion is an electrically powered vehicle that has solar panels on all non-glass parts of its body. The battery provides the Sion with a range of 250km. The on-car solar panels which the company calls viSono can provide another 30km. The top speed is 140km/h and costs 16.000€ without the battery. The battery’s price depends on the final production costs but is estimated to be around 4.000€ (the battery can also be rented on a monthly basis). Whereas Sono Motors does not provide any information about how long one charging circle lasts, the Sion has a quick charing function which charges the battery to 80% in 30 minutes. This equals a range of 200km.

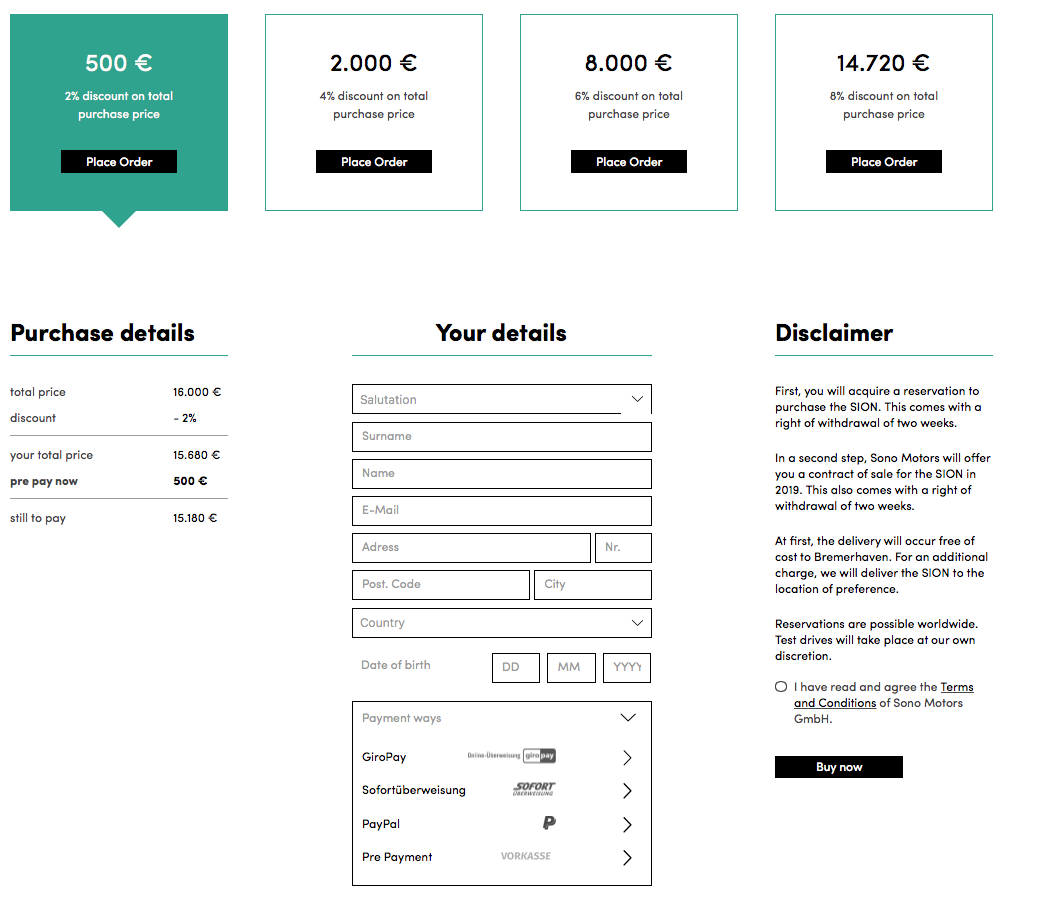

The Sion comes in only one form and color (black) and has no configuration options. Furthermore, it can only be ordered online and picked up at one location in Germany. The online pre-ordering process is extremely simply and involves about as much steps as does buying a phone.

Despite the lack of configuration options, the Sion has a few unique features.

The Sion features

The breSono is a built-in air filtering moss.

With biSono which stands bidirectional charging, the car can be used as a mobile charging station. Through an accompanying app, users of the Sion can share electricity from the Sion’s battery with other Sion users or charge other electric devices.

The goSono is an integrated ride- and car-sharing function which allows ride- and carsharing between other Sion users.

And lastly with the reSone the Sono Motors brings an open-source repair system to the Sion. With that individuals or brand-independent repair shops should be ably to easily repair the Sion. reSono includes online ordering of replacement parts and tutorials for repair work.

All these features should support Sono Motors three values sustainability, affordability and mobility.

Sono Motors values sustainability, affordability and mobility an

Sono Motors markets the Sion as a sustainable, affordable car for inner city transportation, places a focus on mobility and targets the mainstream market with that.

The Sion is a very generic car, a commodity if you will where practicality is the main selling point. The car’s marketing conveys this point and the whole brand appears to be very emotionless. Their purchase process is similarly emotionless and simple. The solar panels mounted at the car support this commodity-attitude. There is, of course, nothing wrong with emphasizing affordability and practicality. However, this is not a source of differentiation but something consumers expect as given. And whereas it is true that cars might turn into commodity eventually (think autonomous taxis) they way in a „Model-T“ future is still very far away. The latest cars shown at the IAA show this direction quite well. The smart vision EQ, for instance, Daimler’s „vision of the urban future of mobility“ is a highly emotional car.

Whereas the rest of the industry is betting on emotional cars (e. g. personal assistants), autonomous driving and connectivity, Sono works on a „getting stuff done“ car with no to little emotional appeal. With all that Sono is trying to reach the mainstream customer and this is where I have trouble believing in Sono’s strategy:

- Their one-point distribution strategy. Customers can pick up the car at only one location (although shipping is possible). Admittedly, they want to built stores in the long-term but the lack of “offline presence” will make testing the car very difficult.

- The car’s features (breSono, biSono, goSono, reSono, and solar panels) are not mainstream features.

- Electric transmissions are — for the mainstream market — a delight feature and not the primary purchase decision.

breSono, biSono, goSono, reSono, and solar panels are not mainstream features

The breSono filters the air inside your car, but that air is usually quite good especially if you only drive short distances and the fact that you can open the windows. additionally it drives the price up. Health enthusiasts would appreciate that, but the Sion is aiming at the mainstream market. Thus I do not see why that feature should be included.

The biSono’s use case is electricity sharing. There are two use cases with that. The fist one is what the company calls powerSharing. With that other Sion owners can use your car as a mobile charging station. There a few things I dislike about that. First, for powerSharing to be useful you need a wide network of Sions. This is a feature that, if at all, should be implemented only once that network exists. Furthermore, even if the network is available finding a Sion-user willing to share battery to the extend that suits your demand and a parking spot next to that cars narrows down the chance of ever finding a match.

The powerSharing’s second use case is a charger for external devices. Sono Motors advertises camping as one example. Camping implies going to a distant location for a couple of days. In this scenario you are

- at risk of exceeding the Sion’s 250km distancesecondly

- at risk of not having a charging station for recharging

- doing something (camping) that not your everyday mainstream consumer would do.

Thus, the biSono — despite a nice idea — is not a feature in accordance with a strategy targeting mainstream consumers.

I see a smilar problem with goSono. Although car- and ridesharing receives a lot of medial attention it is still not something your mainstream consumers uses. Furthermore, it has the same issue as biSono; it requires a network of Sions. And finally, the competition in this field is huge; Uber, car2go, flinkster, … .

Finally, reSono. I am under the impression that the average consumer would never repair a car matter how easy it is. It is an interesting concept but not something for the mainstream.

Finally, the mainstream consumer buys a car because she wants to convey a certain image. I do not think that there is a mainstream market who wants to convey her attitude towards electric cars through a car with solar panels.

With electric transmission the Sion makes a delighter feature the primary purchase criteria but forgets standard features like driving assistants

There is rising interest in sustainability but only as a “delighter product feature”; if the car is electrically powered it is great, if not, you will not be disappointed because you do not except it in the first place. This will, of course, change in the future. In their business plan Sono Motors argues that the need for mobility is the primary purchase criteria for cars [1]. However, in all this one must not forget that when consumers evaluate different engines they except the car to have certain standard features. Amongst others these are driving assistants or in-car „experience“. Especially when driving around the city (again, the use case Sion is targeting) driving assistants such as parking assistants are essential. Sono Motors taking away these and other features will have a hard time reaching the mainstream consumer.

What all this comes down to is that their core market is a small group of people who want a sustainable and affordable car, with mobility services but no other features (e. g. parking assistants). This is a very small market.

Sono Motors, Disruptive Innovation and Vertical Integration

With that in mind, however, Sono Motor’s strategy is, per definition, disruptive:

Generally, disruptive innovations were technologically straightforward, consisting of off-the-shelf components put together in a product architecture that was often simpler than prior approaches. They offered less of what customers in established markets wanted and so could rarely be initially employed there. They offered a different package of attributes valued only in emerging markets remote from, and unimportant to, the mainstream.

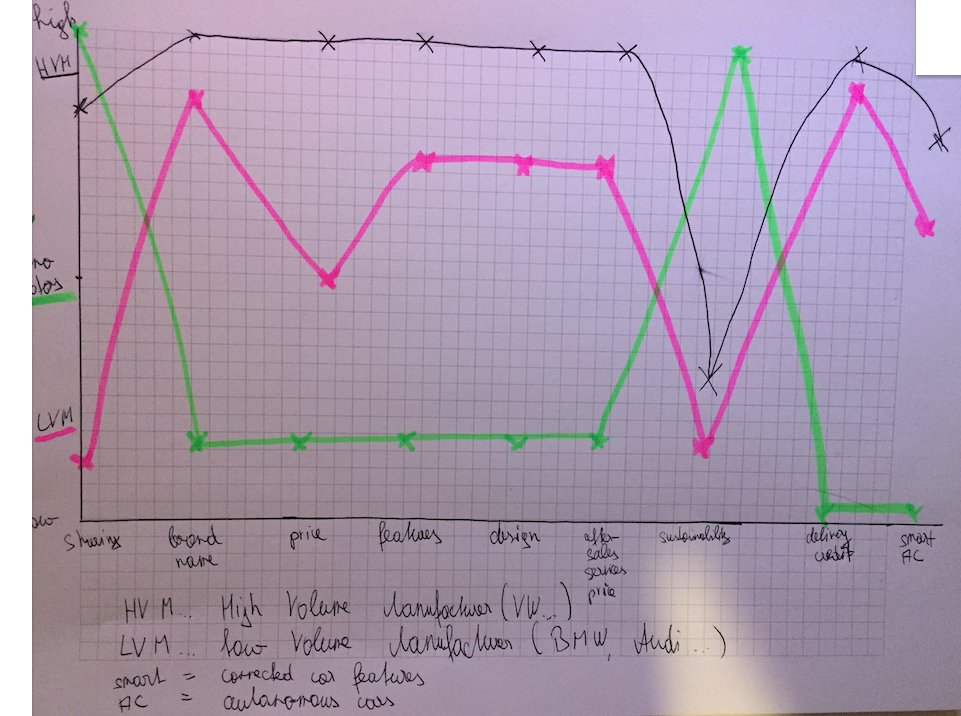

This becomes clear when you look at their strategy canvas:

From there the company plans to first build delivery vans mid-class sedans.

However, I have troubles believing that they will be able to accumalt the money needed to go upmarket. The reasons for that are

- Lack of trending car features (driving assistants, for instance). It it too disruptive for the niche, or the is not niche that would value their feature combination.

- Low prices

- Unintended niche targeting

- Position in the value chain (see below)

Position in the value chain

Sono Motors is not producing any cars on their own, they act as a coordinator between different parties. This leads to the basic questions of why we actually need companies. Ronald Coase first questioned this in his article “The Nature of the Firm”. What it comes down to is that a firm should produce in-house when the internal transaction costs (costs that occur due to internal activities) are lower than external costs (costs that occur due to searching, contratcting and maintaining relationships with external parties). Although this is in this case a highly theoretical calculation (especially without company-specific knowledge) one can conclude that here the external transaction costs are lower than setting up a whole automobile production line. However, this is only true in the short-term.

In the long-term the company will benefit from starting producing as early as possible. Economies of scale, learning and experience curves (lack of R&D and engineering) are the most fundamental reasons for that. By not having direct access to the core of their product I have troubles believing that they will be able to defend them successfully against competitors and suppliers in the long-run (think of the knowledge suppliers are accumulating, eventually sharing with other companies or even integrating forward). Furthermore, they are outsourcing one of the things that make them unique sustainability (batteries and solar panels). On the other side, through making marketing, coordination and design their core competency they can drive down prices. However, this type of manufacturing significantly lower entry barriers for new entrants; the only thing they would need to do is be very good at coordinating.

Notes

[1] Translate from the German original: “ Das Bedürfnis nach Mobilität ist der Hauptgrund für die Kaufentscheidung eines Pkw”