Starling Bank is starting a BaaS-offering. From the press release:

“Starling as a Service” will enable businesses to build their own financial products on Starling’s award-winning banking platform, such as savings or current accounts, integrated digital wallets, kids’ cards and debit cards. Starling handles the technical and regulatory demands behind the scenes, leaving businesses to take care of their customers with innovative embedded banking solutions.

There are several reasons why this move makes sense:

- Diversification: Starlings recent annual report showed that lending was their biggest revenue driver. Marketplaces, however, although growing, played a smaller roll. This indicates a lack of competitive advantage given the fact that the latter category would be able to differentiate Starling from incumbents and neo-competitors.

- Escaping competition: Moving into BaaS is a great way to escape competition with Revolt, N26, and Co.

- Industry demand: There is an every increasing evidence that non-financial companies want to offer financial products.

However, there are also three reasons why that move does not make sense:

- Building a bank and an API at the same time is hard

- Lack of long-term competitive advantage because building a bank is harder than building an API

- Lack of competitive advantage compared to platform-approaches like Stripe

Building a bank and an API at the same time is hard

In the last couple of years FinTechs ‘disrupted’ incumbent banks through two strategies.

First, they unbundled traditional banks into dedicated offerings. The reasons being specialization; if you focus on one thing you can make it better than somebody offering everything. Second, they got rid of expensive retail outlets and moved the customer service online.

With BaaS actually the opposite is happening. First, neo-banks are bundling financial products again. Starling Bank which wants to offer ‘savings or current accounts, integrated digital wallets, kids’ cards and debit cards.’ is a prime example of that.

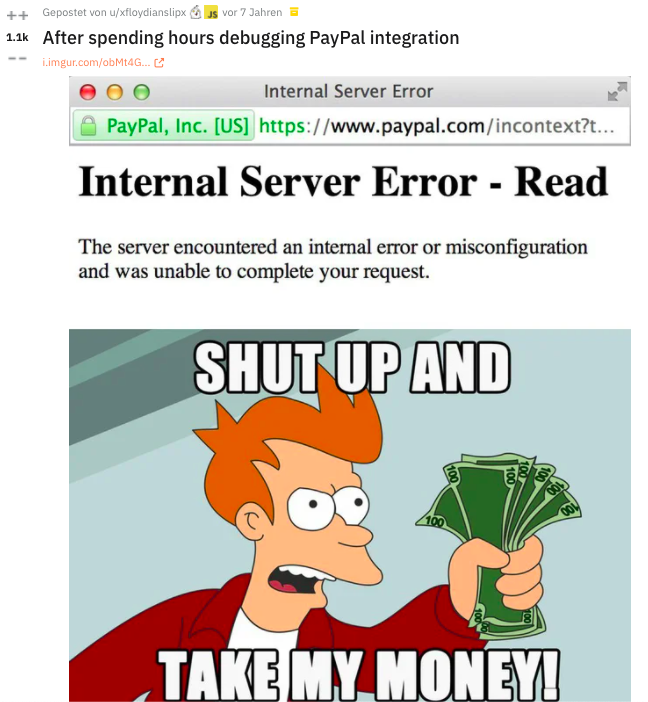

Secondly, they are bringing back retail outlets albeit not in physical form as incumbents do, but in the form of APIs. And similar to retail outlets building an API is hard. As developers on Reddit – albeit from seven years ago – like to point out:

Oh god I hate wiring up PayPal. If you are allowed to switch, try Stripe out. It was actually kinda fun. It gladly took my sandbox money.

Time has shown that that for startups it is difficult to compete in such a vertical market.

For example, NeXT, the company that Steve Jobs founded after leaving Apple. As Andrew Grove, ex Intel-CEO points out in his book ‘Only the paranoid survive’:

The Next machine never took off. In fact, despite ongoing infusions of investors’ cash, Next was hemorrhaging money. They were trying to maintain an expensive computer development operation, in addition to a state-of-the-art software development operation, plus a fully automated factory built to produce a large volume of Next computers—a large volume that never materialized. By 1991, about six years after its founding, Next was in financial difficulties. Some managers inside the company had advocated throwing in the towel in hardware and porting their crown jewel to mass-produced PCs. Jobs resisted this for a long time. He didn’t like PCs. [… ] As Next’s funds grew lower and lower, Jobs finally accepted the inevitability of the inelegant, messy PC industry as his environment. He threw his weight behind the proposal he had fought. He shut down all hardware development and the spanking new automated factory, and laid off half of his staff. Bowing to the “10X” force of the PC industry, Next, the software company, was born.

Lack of long-term competitive advantage because building a bank is harder than building an API

Although building an API is difficult, building a bank is more difficult. Undoubtedly, incumbent banks face tough challenges on their way to ‘APIying’ their business. As Vilve Vene CEO and Co-Founder of Modularbank points out this means getting rid of legacy core banking systems, automating processes:

To compete with other embedded finance providers, traditional banks need to get rid of their technological legacy. This means their services must run on a modern core banking system that allows banks to open up to partners so they can offer services via third parties and ultimately reach more customers. At the same time, all processes must be automated as much as possible to keep costs as low as possible.

However, solving these challenges is possible as incumbent banks have shown such as Citibank N.A., Barclays or Goldman Sachs.

Lack of competitive advantage compared to platform-approaches like Stripe

Incumbent banks primarily serve customers across all segments; from big corporations to local repair shops to solopreneurs. However, as Stripe-CEO Patrick Collison points out, this one-size-fits-all model is not practicable:

We have a lot of conviction about this idea that the financial services that a plumber needs will be different from financial services that an e-commerce company needs will be different than financial services that a gym or a yoga studio needs, and they will be provisioned by different companies. Given that we have lots and lots of exposure to those kinds of businesses with our platform partners, this is a great way to get started with that.

And the examples Leif Wienecke lists, shows that this is already happening. Among them Kontist for solopreneurs, Squire for barbershops or Tomorrow for sustainable banking.

Now, considering this need for vertical banks, the question is who will provide these offerings. In Starlings case this could either be Starling itself or some other FinTech built upon Starling’s infrastructure. In the first case, Starling would have to focus on certain segments as they cannot serve everybody. In the second case, they would turn themselves into a second-tier infrastructure provider. Whereas this could work, it – as outlined above – doesn’t provide much competitive advantage. Further, it would put them into competition with BaaS-companies like Solarisbank. And, most importantly, they would compete against BaaS-platform-companies like Stripe.