The report came out in January, at a time where the general market was going downward after doing quite the opposite in the months before or. The team shared the following updates:

- Transactions per second high but still below industry standard

- Stellar showed that they are aware of a need for marketing

- 2017 marked two years of Stellar being battle-tested

- In 2017 smart-contract functionality was added

- Bifrost was released

- Stellar merged several Go repositories into monorepo and there were 128 merged pull requests in 2017

- XLM support added to Ledger Nano S

See below for details.

Relatively high transactions per second, low transaction fees, and marketing-consciousness

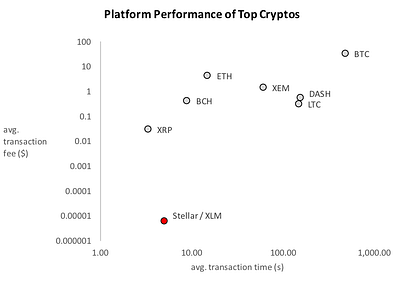

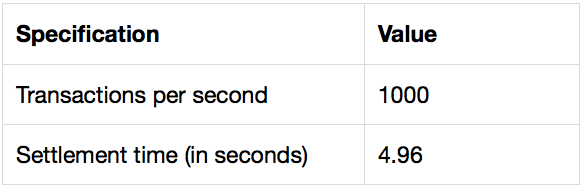

They reported on their transactions per second (TPS) and transaction fees (tf). TPS, although relatively high, are still below current industry standard (e.g. Visa with around 2k).

Also, according to them, they have the lowest average transaction fees compared to selected other cryptos.

As I believe that the whole industry will convergence towards the same fees over time (the same applies to other technical specifications as well) I believe that

- timing (who gets there first) and

- user acceptance (who gains user acceptance first)

will make the difference between winning and losing.

Marketing-consciousness with little substance

In this context I found it pleasing to read that Stellar is focused on marketing as well as engineering:

We pledge to use our resources to ensure that people are talking about Stellar, building on Stellar, and using Stellar in 2020 and beyond

Whereas one must take that statement for what it is — a statement — and results speak louder than words, I consider the mere fact that they are talking about marketing positive because it is important, especially because diffusions of cryptocurrencies consists of two mental steps. As a side note, one of Stellar’s marketing metrics — r.p.w. (randos per week) — is mooning (at least in theory). Check out “Thoughts on Stellar’s 2018 Stellar Roadmap” for more on that.

Engineering and developer information

- 2017 marked two years of Stellar being battle-tested

- In 2017 smart-contract functionality was added

- Bifrost was released (enables token issued on Stellar to accept ETH or BTC)

- Stellar merged several Go repositories into monorepo and there were 128 merged pull requests in 2017. Whether this is a lot is up to you, to me, however, the number doesn’t matter as it makes one confuse activity with results. And only the latter matters.

- XLM support added to Ledger Nano S: Given all the issues around exchanges that’s one of the most important technical updates.

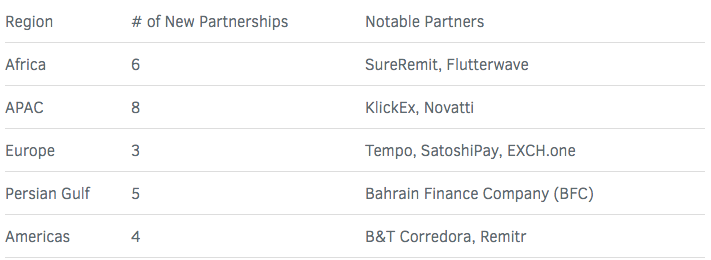

26 new partnerships with lacking details, push vs. pull partnerships, and Tempo the first EUR-based remittance service

Unfortunately, I haven’t followed Stellar for too long so cannot adequately judge their reporting, but so far I believe they were able to strike a decent balance between increasing trust and transparency without creating unnecessary pumps or an over-focus on prices (see Avoiding, Reporting, and Shilling: Three strategies towards crypto partnership reporting for more on partnership reporting). Anyway, they have added 26 news partners. Unfortunately, as they do not specify their nature fully it is difficult to judge their importance. In the case of SureRemit, for instance, it was “only” an ICO done on Stellar. Whereas an ICO is not necessarily a bad thing (but neither always a good thing, see below) it has less importance than, for instance, the partnership they have with Tempo (see below).

Push vs. pull partnerships: more work and significance vs. less work and more momentum

Furthermore, it would be interesting to know how these partnerships came about, i.e. whether they were pushed (Stellar engaging with companies to make it happen or even actively approaching companies) or pulled (entities implementing Stellar without Stellar’s involvement). This distinction is important because the former requires more work from Stellar’ but could yield significant partnerships. Contrary, in the latter case Stellar has no work and it demonstrates that Stellar has reached a degree of brand awareness and trust (“momentum”) high enough for others to come on their own.

Tempo as the first EUR-based remittance service

That being said, one concrete partnership Stellar mentioned was with Tempo. Stellar was very happy about that partnership because it was the first EUR-based remittance service using Stellar.

Besides that, from the public’s perspective most note-worthy was the partnership with IBM in 2017.

Stellar as part of IBM’s platform for international remittances

Together with Stellar and KlickEx Group IBM created a platform for international remittances. I believe that Stellar will profit from that partnership in the short-term; they will learn about their protocol, industrial requirements, and partner-management. In the long-term, however, I am unsure about the impact as the partnership seems to be temporary. From IBM’s press release:

Initially, Stellar will provide the network and digital asset to facilitate the settlement of transactions cleared on Hyperledger — Source IBM.

Besides that, there are two other interesting aspects, Technical forward-integration threatening Stellar’s USP, and the IBM partnership representing an example for a socio-technical system.

Technical forward-integration threatening Stellar’s USP

I do not know what IBM’s Blockchain and IBM itself is capable of but I think it is important to keep in mind that they — or anybody else for that matter — could implement “Stellar” into their own platform, especially as it is open-source. This once again highlights the importance of timing and user acceptance mentioned above.

IBM partnership as an example for Blockchain as a socio-technical system

IBM’s hybrid solution (merging IBM’s and Stellar’s Blockchain) is another example for Blockchain and Co. being a socio-technical system. From Bitcoin, Blockchain, and Cryptoassets: discussing bubbles vs. discussing socio-technical systems

Among other things this socio-technical perspective implies that […] the new technology shows its revolutionary power only ones it becomes foundational, that it unfolds its potential only when coupled with other technologies […]

With IBM and Stellar, both characteristics are observable. Stellar has become the foundational technology for IBM’s remittance solution and only through that Stella’s revolutionary power was “unleashed”. Furthermore, Stellar only “unfolds its potential” when coupled with other technologies, in this case with IBM. I am not saying that Stellar in itself isn’t potential, and “revolutionary power” is a blatant exaggeration, but I still take the view that IBM’s solution provides a nice way to look at Blockchain’s potential and how it might unfold.

Mobius and Smartlands first Stellar ICOs and quantity vs. quality regarding ICOs

They recapped on Mobius and Smartlands being the first to do their ICO on Stellar. Regarding ICOs on Stellar, I share the common belief that they will be positive for the platform. However, I am cautious about quantity vs. quality because I can imagine that a range of „bad“ ICOs will cause the opposite. Admittedly, for Ethereum, which has had its fair share of “bad” ICOs, no negative impact was perceivable so far. Furthermore, most “bad” ICOs were so due to the projects’ designs and not because of Ethereum itself.

“Unhealthy” growth in network metrics (daily trades and number of accounts)

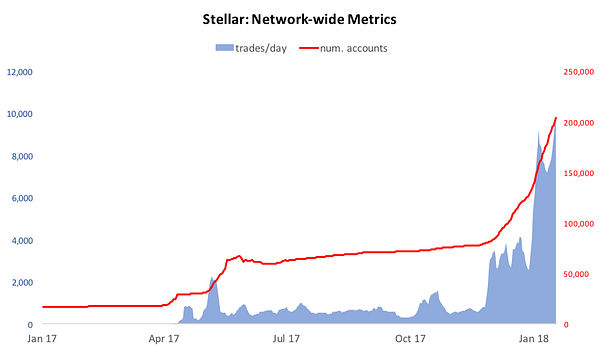

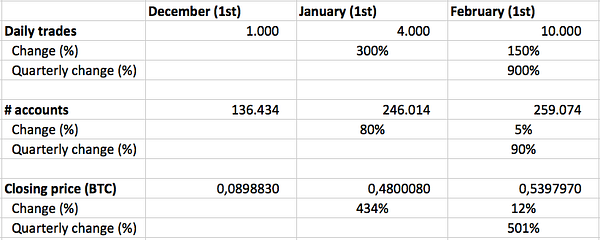

Stellar showed two network metrics: daily trades and number of accounts. Both have grown YOY.

However, it doesn’t look healthy as both spiked in the last two months; daily trades spiked from around 1k in December to 4k in January and to 10k on end of January. This equals a monthly increase of 300% and 150%, respectively or a quarterly increase (December to January) of about 900%. The increase in num. of accounts was less steep but still significant by an increase of about 80%.

Caution towards network metrics: active vs. total accounts, financial vs. technological interest, and unrealistically high bar for future expectations

Whereas these figures are impressive, caution is required. Firstly, the num. of accounts are total accounts and not necessarily active ones. Secondly, the fact that prices and network metrics rose similarly steeply lets me hypothesize that the increased network metrics — especially trades — arose from interest in ROI rather than technology.

Finally, and maybe the most worrying aspect are the expectations such astronomic increases set. If this month’s performance was created by interest in returns and not technology we can expect future growth to slow. The question then is, of course, how such an underperformance will affect technological interest (e.g. will that influence potential industrial partners in their decision-making).

As a side note, less future growth could certainly lead to a setback in price, but that should only be temporary and is thus of no relevance here.

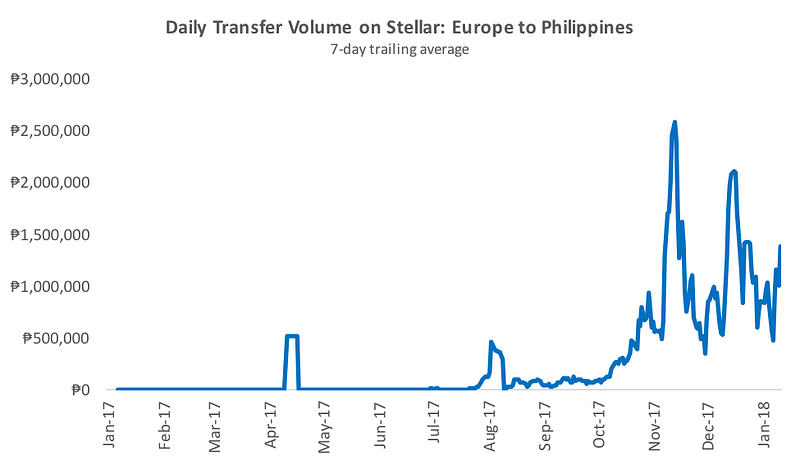

Updated daily transfer volume for Europe/Philippines (without context)

They also shared their daily transfer volume for Europe/Philippines which reached its ATH in November 2017 but started declining afterward. I wouldn’t interpret too much into these numbers due to their short time frame and lack of context (total Europe/Philippines transfer volume and transfer volume on other corridors). I will follow-up on this in subsequent posts.