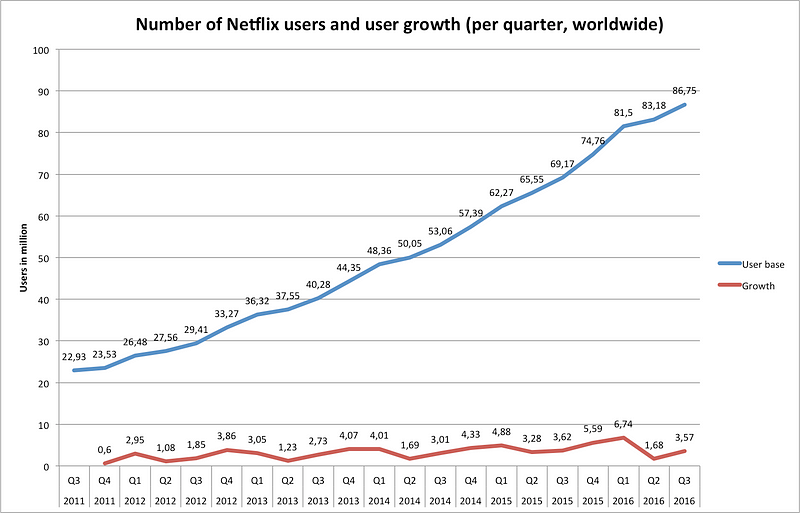

I am currently read Frank Rothaermel’s Strategic Management: Conceptsand also doing the “Chaptercases” (case studies at the end of each chapter) and posting them here on my blog. Chapter seven’s “Chaptercase” happens to be about Netflix, which is a nice coincidence as Netflix recently published its earnings for Q3 2016; its last quarter’s user growth exceed its expectations in the U.S. as well as in international markets. The streaming service currently has about 86,75 million users in total (see statistic below for details).

So, here are the questions from the case study:

- Netflix growth in the United States seems to be maturing. What other services can Netflix offer that might further demand in the United States?

- International expansion appears to be a major growth opportunity for Netflix. Elaborate on the challenges Netflix faces going beyond the U.S. market. What can Netflix do to address some of the challenges encountered when going internationally?

Netflix growth in the United States seems to be maturing. What other services can Netflix offer that might further demand in the United States?

- Original content: The company has given that answer in the letter to shareholders. Netflix has been creating on content for four years now and user growth in Q3 2016 was boosted by Netflix originals such as Stranger Things or Narcos.

- Downloadable content: Further, the company stated that it was considering downloadable content, which would allow to watch shows and movies offline.

- Partnerships and licensing: These options were also mentioned during the interview. One of the licensing options is with he Walt Disney Co. by licensing Quantico in the US and Canada. Besides partnerships with Roku, Google, Apple and smart tvs in general by offering the Netflix app on these companies’ streaming devices (Roku, Google Chromecast and Apple TV) it has recently also partnered up with Comcast by offering access to Netflix on Comcast’s X1 set-top box. Side note: Although, for example, an article on Recode states that that partnership is a “very big deal” , the company’s CEO Reed Hastings put that into perspective by arguing that Comcast users tend to be pretty advanced, high-income households, so many of them already have Netflix. Another option was mentioned indirectly in the article: The company has lost users due to increased prices. Following the logic of the price elasticity of demand this implies that lower prices would result in growing user base.

In addition to this, lets look at some of my own suggestions and ideas.

Netflix believes that it can grow to 60–90 million members in the US and currently has about 48 million. Lets be very pessimistic and argue that they can reach a maximum of 70 when — and Netflix raised this concern in the letter to shareholders — Amazon Video becomes global, getting a boost by its self-made Jeremy Clarkson show. So, Netflix could grow another 20 million users by further creating original content, partnering with other producers to increase its line-up and delivering its content through new kinds of devices. Let’s talk about new devices. Here are a two device should have an eye on.

- Smart speakers: You cannot watch TV on Google Home or Amazon Echo/Dot but you can use them to control your TV which you can use to watch Netflix. Google has already integrated YouTube into Google Home and Amazon certainly will as well make sure that you can use Echo or Dot to start a movie from Amazon Video. Google announced that Netflix will be supported on Google Home in the future. Netflix will have to see how much emphasis they want to put on which smart speaker, if at all.

- Virtual Reality (VR) headsets: I think that VR is still in a very early stage in the industry life cycle, but from what I have experienced and seen it looks great. Netflix is already on Google’s VR headset Daydream. But so are its competitors Google Play Movies, Hulu, YouTube and HBO Now. Netflix will especially consider if and which other VR headsets it wants to support moving forward and how much it wants to invest in it. If VR proves to be a huge success and Netflix underestimates it, history might repeat itself and Netflix could become the next Blockbuster.

Netflix is a business competing against three strategic groups:

- VOD (Video On Demand) competitors: Amazon Video, Hulu etc.

- Linear TV competition: TV broadcaster

- All other services and product competing for screen time: Snapchat, Facebook, Pokémon Go, game consoles and the like

Additionally there are users who do not fall in neither of these categories, which is a presumably small group.

So, essentially Netflix has three type of users they can target: those who use VOD services, those who watch TV but not on demand and those who use neither but spend their time on social networks or with games. Here are several ways how Netflix could capture that audience:

- Second screens: There is enough evidence from Twitter that user like to tweet while watching TV. And this is something Netflix should take upon: Netflix is already well-known and by developing a social network video app where people talk about current shows or movies they are watching in real-time (i.e. while they are watching them) they could capture some of the time people spend with Snapchat and the like. Similarly, they could take some of the attention of the linear TV watching people. They might even partner with Twitter. Consider that Facebook for one has more than 1 billion daily active users.

- Own VR headset: This might sound risky but the market is still very young and developing. Google, Sony, Microsoft, Facebook, HTC, Samsung, Razer and Fove are early adopters testing the market and the devices, new entrants and users are letting them see whether it has potential or not. Being a company also means taking risks; Netflix would should take a shot and get into the ring and try to carve out a competitive position for itself. And it has good chances to offer an unique experience through its original content.

- Additional entry points: Many of Netflix’s VOD competitors have second contact or entry point to their users: YouTube has Google and YouTube itself. Google and YouTube are both ways where people look for trailers of movie information. Especially dangerous for Netflix is that you can watch whole movies directly on YouTube. If you, for example, search for Civil War on YouTube because you want to watch a trailer, one of the first entries is the whole movie which you can buy and watch directly on YouTube. Amazon Video can tap into its existing user base and Hulu has a strong user base and distribution networks through its owners (Comcast, The Walt Disney Company and Time Warner). Google and Amazon also have hardware products such as the above mentioned smart speakers or Google with its Chromecast (a TV dongle which turns any TV into a smart tv with installable apps and which you can also use to stream content from you PC or other devices to your TV). In addition to the above-proposed VR headset, Netflix might consider set-top boxes, dongles or smart homes. Netflix has experimented with smart home devices already and seeing what has been going on lately in that sector it might be a good time to re-inaugurate it (look once again at the smart speakers).

- Broader scope: Looking once again at Netflix’s competitors you can see that many of them offer more than TV shows and movies. Amazon has Twitch (video platform and community for gamers), YouTube has user-generated content and Hulu has the newest episodes usually one day after they air. Netflix can take some of the existing products and offer them as well: Streaming of e games, educational content, live streams, news, possibly even podcasts etc. or mimics Amazon’s kindle direct publishing and allow users to submit self-made movies, shows and comedies. They would, however, have to place a great focus on quality control to not end up having clips and similar like on YouTube. Just consider that YouTube supports 50 languages and Netflix 22.

International expansion appears to be a major growth opportunity for Netflix. Elaborate on the challenges Netflix faces going beyond the U.S. market. What can Netflix do to address some of the challenges encountered when going internationally?

Man of the challenges were mentioned in the earnings call. Here is a summary including additional notes form my side:

- Regulations: Netflix will currently not expand into China due to heavy regulations. Instead it decided to work by licensing to existing services. I considers licensing a major issues because it diminishes Netflix’s already threatened (through, for example, Amazon) competitive of creating original content. They might take a similar approach as they tried with Blockbuster in the beginning (Reed Hastings, Netflix’s CEO offered Blockbuster in 2000 to buy Netflix for $50 million. Netflix would then, under the name of Blockbuster, run Blockbuster’s online presence. Blockbuster turned the offer down as you might have guessed.) or as Uber did recently with its Chinese competitor Didi (the two companies merged their China operations).

- Content-scalability: Although some shows and movies incur global success, country-specific difficulties exist. These difficulties are due to finding finding local film makers with adequate expertise but also understanding the local culture and preferences. In regards to “globally-accepted” content one difficulty lies in translating and subtitling the content which — as Netflix has experienced — can be an error-prone and slow process. I really believe that a community approach (as mentioned above) can be really helpful here (allowing users to submit own content). Another possibility would be to engage the community to subtitle the shows and movies.

- Asymmetry in cash-in and -outflow: Producing original content incurs huge fixed costs long before it actually generates any income.

- Maturity: Netflix launched in 130 countries in Q1 2016 and there as just that many countries Netflix can expand into. That is also why Netflix anticipates lower growth rates in the future. Once they are in major countries the same issues apply as currently in the U.S.

- Industry life cycle: Some countries are just not yet ready for VOD because they are still watching linear TV or their internet speed is not fast enough. Facebook and Google are coping with this problem by investing in Internet infrastructure (Google’s Project Loon and Facebook-led Internet.org for internet in rural areas or Google Fiber for high-speed internet). Netflix might not have enough financial resources to push such a project but they still have to make sure that not other competitor captures that market before them. In these countries Netflix might focus more on DVD rentals, or “download stations” where users would visit locations (e.g. shopping malls) with these stations where a number of shows and movies would be downloadable onto a flash drive from such a terminal. Netflix might as well divert a bigger part of its R&D budget into the development of high-compression film formats or the acquisition of companies with such an expertise.

- Technical issues: People share their accounts (password sharing) or try to access content outside their geographic rights using VPNs. Password sharing is something — as the company acknowledges — “you have to live with” because it is difficult to handle as it differentiating between legal and illegal password sharing is not always easy. In regards to geographical filtering Netflix has been quite successful in blocking technologies bypassing its geographical rights. A recent example is Uflix (a service to expand your movie library and that allows you to access content that is normally unavailable in your location) which has given up on bypassing Netflix’s filter because the company keeps blocking the workarounds.

- Local competitors The more countries Netflix launches the more it gets threaten by small local competitors. This is linked to many of the above-mentioned points, especially content-scalability.